Best car insurance companies

Which car insurance company looks after you best when you make a claim? Our Driver Power survey compares the big hitters

Insurance may not be the first thing you think of when car-hunting (although checking premiums before shopping for a new set of wheels is wise), but, as a legally mandated financial product, car insurance is essential before you venture out on the road.

Yet choosing the right car insurance company to insure your car can be a minefield. Failing to shop around come renewal time can cost a fair amount of money because, for example, so-called ‘loyalty’ pricing often means existing customers are faced with automatically renewing premiums that cost more than the previous year’s cover.

• Click here to take our Driver Power survey right now

Research into the effects of loyalty pricing by the Financial Conduct Authority may curb some of the worst excesses of this practice, but keeping an eye on the insurance market is still wise.

Some insurers have a better reputation than others for offering a hassle-free experience, taking care of you when the time comes to make a claim, for example, as well as offering helpful services such as courtesy cars, legal cover and easily accessible claims lines.

Our Driver Power rankings for the best insurers should be your first port of call when deciding which company to choose. Each firm is ranked and rated in close detail, with seven category scores taking into account everything from how easy cover is to buy, to how quick firms are to pay up for claims.

Adding colour to these statistics are real-life comments from customers about their experience with the companies in question, and a percentage score for the proportion of people who would renew their policy with the same insurer.

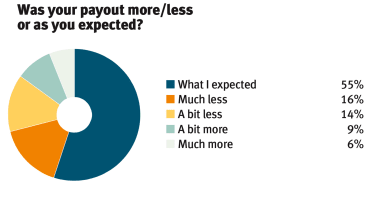

Was your payout more/less or as you expected?

The UK’s general insurance industry is worth around £90billion, and makes up more than one per cent of the country’s GDP. With such vast quantities of money sloshing around, it’s good to report that the majority of you received as much as or more than you expected from your insurer when making a claim. That’s not to say the system is perfect: almost a third of drivers received less than they thought they would, and those who felt under-compensated were more likely to say they should have got a lot more money than they did, rather than a bit extra.

When it comes to how long the claims process took, 47 per cent of policyholders got their money within a month, with a further third waiting between one and three months. But for the 12 per cent who said they had to wait between four and six months to receive payment, things could certainly move more quickly.

How long have you been with your current provider?

Loyalty is something to be rewarded and admired generally, but when it comes to insurance, sticking with your company could hit you hard in your wallet. That’s because many (although not all) firms work on the principle of loyalty (or inertia) pricing, automatically increasing your premiums each year in the hope you will just renew your policy anyway.

One in 20 of our respondents said they had been with their current provider for more than a decade, but the fact 62 per cent have only been with their insurance firm for two years or less indicates most drivers are wise to the merits of switching providers, shopping around fairly regularly to secure the best deal.

When you consider that 62 per cent of readers report that premiums have either stayed the same or increased compared with the previous year, it’s clear that while insurance firms may be good at attracting new customers, retaining existing ones isn’t at the top of their list of priorities.

How did you acquire your car insurance?

While car dealerships, despite a few notable exceptions, are firmly rooted in the ‘bricks and mortar’ business model, the insurance industry has embraced the Internet to great effect, with 80 per cent of you buying cover online, and most doing so without calling the firms’ helplines.

Price-comparison sites are part of this picture, but not all providers’ products are on these sites. It’s also worth noting that some comparison sites are owned by insurance firms, so shopping around is advisable, even when using an aggregator.

But not everything happens online: one in five of you arranges car cover over the phone, so companies offering this service to buyers are still catering for a meaningful proportion of the market.

Interestingly, while 43 per cent of drivers buy cover through price-comparison sites, 51 per cent go directly to the insurer or use a broker, with the remaining customers getting free cover with a company car, a new-car purchase, or via some other means.

The best car insurance companies

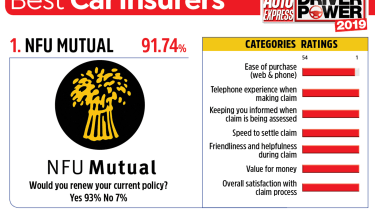

1. NFU Mutual – 91.74%

Posting results many firms can only dream of, NFU Mutual – the National Farmers’ Union Mutual Insurance Society Limited – was founded by seven farmers in 1910, but now counts more than 900,000 member-customers as its owners. You’ll need to go directly to NFU to take out a policy, because the brand isn’t on comparison websites, but being a farmer is not a requirement, and those who check out the firm have nothing but praise for it. One look at the bars to your right tells you all you need to know: NFU Mutual came top in five of seven categories, and an amazing 93 per cent of policyholders would renew. A worthy win, and the fourth gold medal in a row for NFU Mutual.

Would you renew your current policy? Yes 93% No 7%

Buy car insurance from NFU Mutual

Case study: Adrian Sharpington

Lives: Biggin Hill, LondonDrives: Honda Civic

Having previously worked in the insurance industry, Adrian Sharpington knows how to tell good providers from bad. And, when Adrian read about NFU Mutual’s multiple Driver Power wins in Auto Express, he decided to look at choosing them as his next insurer.

“They came out on top and I thought: ‘That’s a good enough recommendation’,” said Adrian, who proceeded to telephone NFU for a quote.

“I got straight through,” he explained. “I’ve never had a problem ringing them, as you so often do these days when companies will put you on hold for 25 minutes!

“I’ve had no problem with them at all. Very nice, pleasant staff. I have no complaints and I’d recommend them to anybody from my experience.”

When he first retrieved his quotes from NFU, Adrian haggled slightly, although he was still happy to pay a small premium in order to be insured with what was considered a reputable company.

“I did haggle and they came down. They were fairly competitive. I found some cheaper quotes, but they were not from companies I would want to insure with.”

And, while the process of renewing your car insurance often involves a phone call to your current provider to negotiate over an inflated auto-renewal price, Adrian hasn’t had this issue with NFU. “This year, I didn’t argue with them,” he told us. “They were fair.”

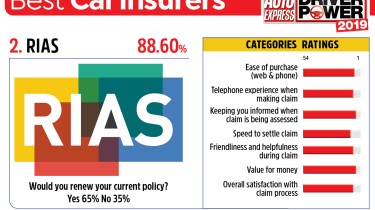

2. RIAS – 88.62%

RIAS rises nine places from last year to take our silver medal in the 2019 Driver Power insurance results. The firm, which is part of Ageas, posts a strong suite of scores that stand scrutiny in almost every area. We say almost, because a disappointing proportion of RIAS’s customers would not renew. But, elsewhere, the news is positive: few other companies offer better value for money, according to our readers, while RIAS policies are easy to purchase, and the insurer’s agents do a great job of keeping you informed. Impressively, the firm even posts its managing director’s E-mail address on its website, so customers can get in touch directly with feedback, be it positive or negative.

Would you renew your current policy? Yes 65% No 35%

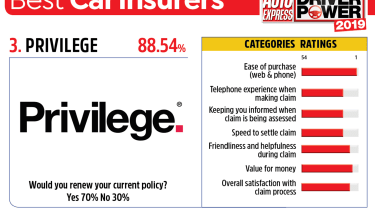

3. Privilege – 88.54%

Privilege is part of the Direct Line Group, and its customers tend to come through price-comparison sites. Despite the fact this means few will have deliberately sought out the firm, policyholders have almost nothing but praise for the firm. You’re most impressed with the purchasing process, but when the time comes to lean on your policies and claim, Privilege stands up to the test. Yes, the telephone experience when claiming could be fine-tuned, but agents are helpful, and you think the company offers strong value for money. The fact a below-average proportion of customers would renew with Privilege may be linked to the way that people came to the company.

Would you renew your current policy? Yes 70% No 30%

Buy car insurance from Privilege

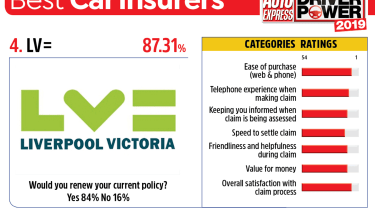

4. LV= – 87.31%

LV=, previously known as Liverpool Victoria, is a mutual society, so it has no shareholders and is owned by its members, with that status being given to customers. LV= has around five million members and seems to be keeping its car-insurance contingent happy, as shown by its fourth-place finish here, and third place in 2018. A strong set of scores almost across the board this year indicates that LV= impresses in most areas, with the purchasing and claims process felt to be impressively easy. While you say that claims could be settled a little more quickly, 84 per cent of members would renew their LV= car-insurance policies; that’s the fourth-highest proportion in our results.

Would you renew your current policy? Yes 84% No 16%

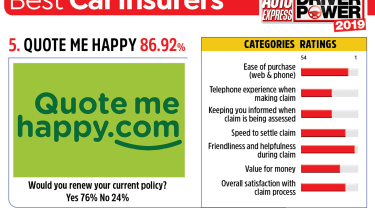

5. Quote Me Happy – 86.92%

A budget-friendly arm of Aviva, Quote Me Happy’s customers have generally positive things to say about the firm, which appears to be living up to its billing. You’re most pleased with how helpful staff are while the claim is processed, but you also have nice things to say about the speed of settling claims, are impressed with how easy taking out a policy is, and are generally satisfied with the claims process. Quote Me Happy could offer better value for money, though, while claims handlers don’t seem to be knocking it out of the park when you have to make a claim in the first place. An above-average proportion of customers would renew with Quote Me Happy, though.

Would you renew your current policy? Yes 76% No 24%

Buy car insurance from Quote Me Happy

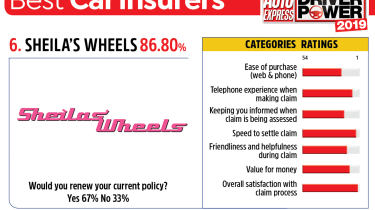

6. Sheila’s Wheels – 86.80%

Launched in 2005 with a memorable ad campaign, Sheila’s Wheels injected some fun into the insurance marketplace, but its ownership can be traced back to Bain Capital, which has £85billion worth of assets under management and was co-founded by US politician Mitt Romney. Whatever its provenance, Sheilas’ Wheels customers are a happy lot, saying the firm settles claims quickly, provides a strong telephone service during the claims process, and offers good value for money. The purchase process could be smoother, and information could be more forthcoming during the claims process but, overall, Sheila posts a strong set of results.

Would you renew your current policy? Yes 67% No 33%

Buy car insurance from Sheila's Wheels

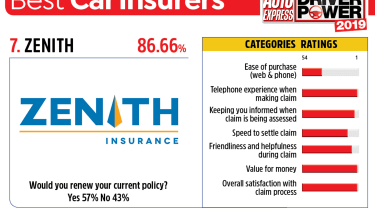

7. Zenith – 86.66%

Part of the Markerstudy Group that operates Lancaster Insurance, Auto Windscreens and a charter-jet firm, Zenith (formerly Chaucer Insurance) is part of a broad portfolio of companies, but the brand is well regarded by customers. Buying your insurance from Zenith isn’t the last word in convenience, but the firm offers strong value for money and has a friendly and helpful claims team; this latter aspect helps Zenith take a silver medal for the overall claims experience. Almost half of policyholders say they wouldn’t return, so either renewal quotes are uncompetitive, or customers are driven to the brand through comparison websites, and are therefore more likely to shop around.

Would you renew your current policy? Yes 57% No 43%

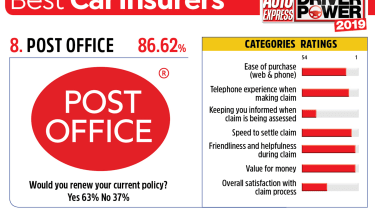

8. Post Office – 86.62%

Strong scores from the Post Office’s insurance arm, with customers reporting back on a number of areas in which the firm impresses. Most worthy of note are the two fourth-place rankings for how friendly staff are during the claims process, and the value for money offered by the company’s policies. But Post Office agents need to do better when it comes to keeping you informed of what’s happening with your claim, while the overall satisfaction figure for the claims process is low. Given that a high proportion of customers say they wouldn’t renew their Post Office policies, it seems the firm has some key areas of improvement if it wants to encourage more repeat business.

Would you renew your current policy? Yes 63% No 37%

Buy car insurance from the Post Office

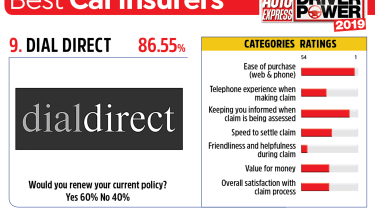

9. Dial Direct – 86.55%

Part of the giant BGL Group, which is also behind comparethemarket.com, Dial Direct bundles free RAC breakdown coverage with its policies, but this isn’t enough to raise its value-for-money score. Considering that we’re in the upper reaches of our rankings, it’s disappointing to see a second-from-bottom assessment given to the friendliness on display during the claims process. So why does it feature so highly in our table? Few other companies were judged to be so easy to purchase from, while those having to claim say they were given a good amount of information. However, a whopping 40 per cent of customers still said they wouldn’t renew with Dial Direct.

Would you renew your current policy? Yes 60% No 40%

Buy car insurance from Dial Direct

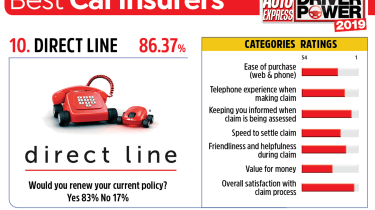

10. Direct Line – 86.37%

One of the UK’s best-known insurance firms, which launched back when telephones with cradles and separate handsets were the norm, Direct Line was the UK’s first insurer to sell directly to customers, rather than through a broker. Ironically, for a firm with a phone mascot (although this has been joined by a computer mouse in recent years), it posts reasonable rather than exceptional scores for the phone experience during claims. There’s no arguing with impressive results for the value for money offered by the firm, nor how good it is at keeping customers informed. That, together with a high level of satisfaction with the overall claims process, more than justifies Direct Line’s place in the top 10.

Would you renew your current policy? Yes 83% No 17%

Buy car insurance from Direct Line

Specially commended: Police Mutual

Police Mutual is something of a specialised company, offering financial services such as loans, mortgages and car insurance to serving and retired police officers, staff, and their relatives. But while those conditions prevent most of us from taking out a car-insurance policy with Police Mutual, customers rate it so highly we wanted to give it a Driver Power Special Commendation, recognising feedback that sees 94 per cent of policyholders say that they would renew with the organisation. So while these policies are not available to most of us, many insurers would do well to look hard at what allows Police Mutual to provide such a satisfying experience for its customers.

Buy car insurance from Police Mutual

Lowest ranked car insurance companies 2019

21. Halifax – 85.80%

Named after the Yorkshire town in which it was founded over a century and a half ago and now part of the Lloyds Banking Group, Halifax falls slightly from last year’s tables, where it came 17th, with a collection of fairly middling scores. You’re not impressed by the telephone experience or how friendly staff are during the claims process, don’t judge the company to offer good value for money, and say that claims take too long to settle – although overall you report the claims process isn’t too bad. But while it’s fair to say that Halifax insurance policies are easy to buy, according to our survey results, the rest of the customer experience would appear to be rather disappointing.

Would you renew your current policy? Yes 63% No 37%

Buy car insurance from Halifax

22. Swinton – 85.76%

UK firm Swinton climbs from 27th place last year, with results that indicate your initial impressions during the claims process are good. That’s thanks to a top-five mark for the telephone experience, and a decent result for how friendly agents are throughout the claims process. But this isn’t backed up elsewhere in the customer experience. The low mark for how long it takes Swinton to settle your claim indicates incidents and accidents are made more frustrating by the time it takes to receive recompense, while value for money is another area where rivals are judged better. This feedback is reflected in the fact that almost a third of you said you wouldn’t renew your policy with Swinton.

Would you renew your current policy? Yes 69% No 31%

Buy car insurance from Swinton

23. Bell – 85.54%

Our first riser in the 2019 rankings, Bell climbs from its 28th-place finish last year, posting a mixed bag of results in the process. The firm, previously known as Bell Direct, is part of the Admiral insurance group and dedicates its services to drivers wanting ‘black box’ telematics insurance policies. Characterising life as a Bell customer is an impressive telephone experience, should you need to make a claim, and this mark is bolstered by a genuinely impressive second place for how well informed customers feel throughout the claims process. Unfortunately, you’re not sold on how easy it is to take out cover with Bell in the first place, while other firms offer better value for money, you say.

Would you renew your current policy? Yes 74% No 26%

24. Aviva – 85.24%

The UK’s largest insurance company, and a firm that can trace its roots back to the turn of the 18th century, British multinational Aviva also suffers a big drop in this year’s rankings, even if its fall isn’t as sharp as AXA’s (it came 15th last year). Dragging Aviva’s scores down is a purchasing process you say is anything but simple, but it’s not all bad news: being ranked 11th for overall friendliness during the claims process indicates that Aviva agents do their best to help when you pick up the phone in your hour of need. That mark is tempered, however, by a mid-table ranking for the length of time it takes to settle claims, and only a so-so score for the overall claims experience.

Would you renew your current policy? Yes 73% No 27%

25. AXA – 85.12%

French firm AXA is one of the biggest players in the business, but takes a huge tumble from 2018’s Driver Power rankings, when it was rated the fifth-best insurer on the market. What’s caused that fall from grace? Well, you weren’t thrilled in 2018 about how easy it was to buy cover from AXA, and that remains the case this year. And, for 2019’s scores, you’re far less pleased than you were about how well informed the firm keeps you during the claims process, and are less polite about the length of time it took to settle your claim. While in 2018 64 per cent said you would renew your AXA policy, that figure rose by two per cent this year, yet it’s still one of the lower proportions in this survey.

Would you renew your current policy? Yes 66% No 34%

Now check out the best cars to own in 2019, as decided by our Driver Power survey…

Find a car with the experts