Urgent action needed to “re-enthuse” private EV buyers, say car makers

The proportion of EVs sold to private buyers in April slumped 22 per cent compared to April 2023, as EV fleet sales motor ahead

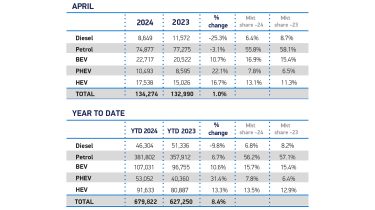

The latest sales figures have confirmed industry warnings that private buyers remain to be convinced of the merits of battery-powered EVs, with just 15.6 per cent of the total number of EVs sold in April going to retail customers.

That’s a worrying 21.9 per cent drop in the proportion of EVs going to private buyers compared to April last year, when 22.1 per cent of all EVs were sold privately. In contrast, fleet sales continue to push the EV sector forward, as big government incentives on benefit-in-kind tax for company cars continue to drive demand.

As a result of those booming corporate sales, electric car registrations rose by 10.7 per cent, lifting April market share to 16.9 per cent, compared to 15.4 per cent in April last year.

Overall, the new car market in April grew by what the Society of Motor Manufacturers and Traders calls a “modest” 1 per cent, to a total of 132, 274 units. Large fleet registrations accounted for 81,207 units - an increase of 18.45 per cent - while sales to private buyers declined -17.7 per cent to 50,458 units.

In the light of its latest figures, the SMMT’s April sales statement calls for “urgent action to re-enthuse private buyers into switching” to EVs. It points out that while drivers have the widest-ever choice of EV models, and increasingly compelling offers from manufacturers, “the lack of government incentives for private motorists remain a barrier that cannot be overcome by industry alone”.

The SMMT has repeated calls for a temporary 50 per cent to VAT on EVs, and is urging changes to the ‘expensive car’ supplement to Vehicle Excise Duty (road tax), which will hit many EV buyers with much bigger bills from April next year. Also on on the SMMT’s lobbying agenda is more action on charging infrastructure. It says there is currently just one standard charger available for every 35 plug-in cars on the road, which it says is “a negligible improvement” on the ratio in 2022 when there was one charger for every 36 plug-in cars.

“The new car market continues to grow even in the quieter months, driven primarily by fleet demand,” says SMMT chief exec Mike Hawes. “This is particularly true of the electric vehicle sector, where the absence of government incentives for private buyers is having a marked effect. Although attractive deals on EVs are in place, manufacturers cannot fund the mass market transition single-handedly. Temporarily cutting VAT, treating EVs as fiscally mainstream not luxury vehicles, and taking steps to instil consumer confidence in the chargepoint network will drive the market growth on which Britain’s net zero ambition depends.”

2024’s most popular cars

These were the best-selling cars in April:

- Ford Puma - 4,339

- VW Polo - 3,413

- Audi A3 - 3,010

- Nissan Qashqai - 2,495

- VW Golf - 2,361

- Kia Sportage - 2,192

- VW T-Roc - 2,162

- MG HS - 2,073

- Volvo XC40 - 2,069

- VW Tiguan - 2,004

Looking to buy a new car? Learn more about the top 10 best-selling cars here...

Find a car with the experts