UK electric car sales stick stubbornly short of targets, with more headwinds due

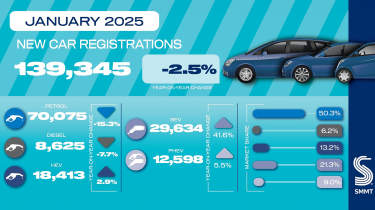

New car sales figures for January show EV demand short of where it needs to be for 2025 ZEV mandate targets, with EV tax rises due in April.

Demand for electric cars still hasn’t crept over the government’s 2024 target of 22 per cent, as manufacturers face an uphill struggle to reach their EV target of 28 per cent of total sales in 2025.

While the total number of EVs registered last month rose year-on-year by an impressive 41 per cent, there’s plenty of anecdotal evidence that car makers may have held back EV orders placed in 2024 to January, so they will count towards the tougher 2025 targets.

Even so, numbers in January only tottered towards last year’s Zero Emissions Vehicle (ZEV) mandate figure of 22 per cent without reaching it - EVs accounted for a 21.3 per cent market share in January according to the latest figures from the Society of Motor Manufacturers and Traders, with the great majority being registrations for fleet and business users. Across the month, 78.9 per cent of all new electric cars were delivered to corporate users, while private buyers accounted for just 21.1 per cent of the new EV market.

That slow rate of private uptake is seemingly hard to budge, and manufacturers have warned that the imminent arrival of road tax changes in April - which will add £1,000s to the cost of most new EVs - is likely to further dampen consumer enthusiasm for the EV transition.

From April, electric cars costing more than £40,000 - the great majority of those on sale - will lose their current exemption from the expensive car ‘road tax’ supplement, adding £410 to their annual VED rate for the first five years, which is a £2,050 additional hit.

“January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions,” says the SMMT chief executive Mike Hawes. “Affordability remains a major barrier to uptake, and the application of the ‘Expensive Car Supplement’ to VED on electric vehicles is the wrong measure at the wrong time. Rather than penalising EV buyers, we should be taking every step to encourage more drivers to make the switch, helping meet government, industry and societal climate change goals.”

It’s not just EV market share bothering car makers though, as the total number of cars registered in January has also fallen back compared to last year. The SMMT blames weak economic confidence for a year-on-year slide in the new car market of -12.5 per cent.

Overall, it anticipates sales in 2025 will reach 1.95 million units this year, which is -0.2 per cent down on 2024, with EV sales reaching 23.7 per cent market share - some way short of the government’s 28 per cent ZEV Mandate.

We’ve recently reported that the government is in discussions with finance companies about the possibility of providing loan guarantees for EV buyers that could reduce the finance cost of the cars. However, John Cassidy, managing director of sales at Close Brothers Motor Finance also chose to highlight the forthcoming VED changes when responding to the latest figures.

“Cconsumer appetite for EVs needs to rise faster than its rate in 2024 if the Government wishes to realistically achieve its 2030 new internal combustion engine (ICE) ban,” he says. “Many would point to the upcoming imposition of vehicle excise duty for electric vehicle owners in April as an example of mixed signals from the Government.”

Subscribe to the UK's favourite car magazine: get Auto Express delivered every week...

Find a car with the experts